Sample EOR Agreement in Malaysia

- Roger Pay

- May 4, 2025

- 14 min read

Updated: Oct 31, 2025

EOR Agreement in Malaysia Details

Here's a complete, legally binding sample agreement.

EMPLOYER OF RECORD SERVICES AGREEMENT

This Agreement is made on this [Date] day of [Month], [Year]

Between:

[Your Company Name], a company incorporated in [Your Company Jurisdiction] with its registered address at [Your Company Address] (hereinafter referred to as the "Client")

And

Bestar Consulting Sdn. Bhd, a company incorporated in Malaysia with its registered address at 12A-10 Plaza Permata, 6 Jalan Kampar, Sentul Selatan, 50400 Kuala Lumpur, Malaysia (hereinafter referred to as the "EOR")

WHEREAS:

The Client desires to engage individuals to perform services in Malaysia.

The Client wishes to utilize the EOR's expertise and services to legally employ and manage these individuals in compliance with Malaysian law.

The EOR is engaged in the business of providing employer of record services in Malaysia.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, the parties agree as follows:

1. Definitions:

"Employee(s)" shall mean the individuals identified in Schedule A (as may be updated from time to time) who are employed by the EOR but provide services to the Client.

"Services" shall mean the services to be performed by the Employees for the Client as defined by the Client.

"Malaysian Law" shall mean all applicable laws, regulations, ordinances, and legal requirements in force in Malaysia.

2. Scope of Services:

2.1 Employment: The EOR shall be the legal employer of the Employees in Malaysia and shall be responsible for all employment-related obligations under Malaysian Law, including but not limited to issuing employment contracts in compliance with the Employment Act 1955.

2.2 Payroll Administration: The EOR shall be responsible for processing and disbursing the Employees' salaries, including calculating and remitting all applicable taxes (including income tax), statutory contributions (including EPF, SOCSO, EIS), and other mandatory deductions in accordance with Malaysian Law.

2.3 Benefits Administration: The EOR shall administer employee benefits as agreed upon in Schedule B, which may include statutory benefits (e.g., annual leave, sick leave, maternity leave) and any Client-provided benefits.

2.4 Compliance: The EOR shall ensure compliance with all applicable Malaysian Law related to the employment of the Employees.

2.5 Onboarding and Offboarding: The EOR shall manage the onboarding and offboarding processes for the Employees in accordance with Malaysian Law and the Client's instructions.

3. Responsibilities of the Client:

3.1 Employee Selection and Management: The Client shall be solely responsible for identifying, recruiting, selecting, and managing the day-to-day work performance of the Employees.

3.2 Work Instructions: The Client shall provide clear and timely instructions to the Employees regarding their Services.

3.3 Information Provision: The Client shall provide the EOR with all necessary information required for the EOR to fulfill its obligations under this Agreement, including but not limited to employee details, salary information, and benefit elections.

3.4 Compliance with Client Policies: The Employees shall comply with the Client's reasonable and lawful workplace policies and procedures, provided that such policies do not conflict with Malaysian Law.

4. Fees and Expenses:

4.1 Service Fees: In consideration for the Services, the Client shall pay the EOR the fees as set forth in Schedule C.

4.2 Expenses: The Client shall reimburse the EOR for all reasonable and documented expenses incurred by the EOR in the provision of the Services, including but not limited to statutory contributions, employee benefits costs, and any applicable taxes.

4.3 Invoicing and Payment: The EOR shall invoice the Client monthly in accordance with the terms set forth in Schedule C. The Client shall pay each invoice within [number] days of the invoice date.

5. Term and Termination:

5.1 Term: This Agreement shall commence on the Effective Date and shall continue for a period of [duration] (the "Initial Term"), unless earlier terminated in accordance with the terms herein.

5.2 Termination for Convenience: Either party may terminate this Agreement upon [number] days' written notice to the other party.

5.3 Termination for Cause: Either party may terminate this Agreement immediately upon written notice if the other party materially breaches this Agreement and fails to cure such breach within [number] days after receiving written notice of the breach.

6. Confidentiality:

Each party agrees to maintain the confidentiality of the other party's Confidential Information and shall not disclose such information to any third party without the prior written consent of the disclosing party, except as required by law.

7. Indemnification:

7.1 Indemnification by the Client: The Client shall indemnify, defend, and hold harmless the EOR, its affiliates, officers, directors, employees, and agents (collectively, the "EOR Indemnified Parties") from and against any and all claims, demands, actions, suits, proceedings, losses, damages, liabilities, costs, and expenses (including reasonable attorneys' fees) (collectively, "Losses") arising out of or relating to:

(a) The Services performed by the Employees for the Client, except to the extent such Losses directly result from the gross negligence or willful misconduct of the EOR.

(b) The Client's breach of any of its obligations, representations, or warranties under this Agreement.

(c) Any claims of discrimination, harassment, wrongful termination, or other employment-related claims brought by an Employee or a third party that arise directly from the Client's instructions, actions, or inactions with respect to the Employee's work or conduct.

(d) Any claims related to the Client's intellectual property or business operations.

(e) The Client's failure to provide accurate or timely information to the EOR, where such failure leads to non-compliance with Malaysian Law or other liabilities for the EOR.

7.2 Indemnification by the EOR: The EOR shall indemnify, defend, and hold harmless the Client, its affiliates, officers, directors, employees, and agents (collectively, the "Client Indemnified Parties") from and against any and all Losses arising out of or relating to:

(a) The EOR's gross negligence or willful misconduct in the performance of its obligations under this Agreement.

(b) The EOR's breach of any of its obligations, representations, or warranties under this Agreement.

(c) The EOR's failure to comply with applicable Malaysian Law directly related to its responsibilities as the employer of record (e.g., failure to remit statutory contributions correctly due to the EOR's error).

(d) Any claims directly arising from the EOR's employment relationship with the Employees that are solely attributable to the EOR's actions or inactions (excluding those arising from the Client's instructions or management of the Employees' work).

7.3 Indemnification Procedures:

* **(a)** The Indemnified Party shall promptly notify the Indemnifying Party in writing of any claim for which indemnification may be sought.

* **(b)** The Indemnifying Party shall have the right to assume the defense and control of any such claim with counsel reasonably acceptable to the Indemnified Party.

* **(c)** The Indemnified Party shall reasonably cooperate with the Indemnifying Party in the defense of such claim, at the Indemnifying Party's expense.

* **(d)** The Indemnified Party shall have the right to participate in the defense of any such claim with counsel of its own choosing and at its own expense.

* **(e)** The Indemnifying Party shall not settle any claim without the Indemnified Party's prior written consent, which shall not be unreasonably withheld, conditioned, or delayed, if such settlement would adversely affect the Indemnified Party's rights or interests.

8. Limitation of Liability:

8.1 Exclusion of Certain Damages: To the maximum extent permitted by applicable law, neither party shall be liable to the other party for any indirect, incidental, special, consequential, or punitive damages (including, without limitation, damages for loss of profits, business interruption, loss of data, or loss of goodwill), arising out of or relating to this agreement or the services provided hereunder, even if such party has been advised of the possibility of such damages.

8.2 Cap on Liability: Except for liability arising from (A) A party's gross negligence or willful misconduct, (B) A party's breach of its confidentiality obligations under Section [Insert Relevant Section Number], or (C) The client's obligation to pay the EOR's fee and reimbursable expenses, the total cumulative liability of each party to the other party arising out of or relating to this agreement shall not exceed the total fees paid or payable by the client to the EOR under this agreement during the [Specify Time Period, e.g., TWELVE (12) MONTHS] period immediately preceding the date on which the claim arose.

8.3 Exceptions: The limitations and exclusions of liability set forth in this section shall not apply to:

* **(a)** LIABILITY FOR DEATH OR PERSONAL INJURY CAUSED BY A PARTY'S NEGLIGENCE.

* **(b)** LIABILITY FOR FRAUD OR FRAUDULENT MISREPRESENTATION.

* **(c)** ANY OTHER LIABILITY THAT CANNOT BE EXCLUDED OR LIMITED UNDER APPLICABLE MALAYSIAN LAW.

8.4 No Liability for Employee Actions: The Client acknowledges and agrees that the EOR shall not be liable for the acts or omissions of the Employees in the performance of their Services for the Client, except to the extent such acts or omissions directly result from the gross negligence or willful misconduct of the EOR in its role as the employer of record (e.g., failure to process payroll correctly due to the EOR's error). The Client shall be solely responsible for managing the Employees' performance and work.

9. Governing Law and Dispute Resolution:

This Agreement shall be governed by and construed in accordance with the laws of Malaysia.

Any dispute arising out of or in connection with this Agreement shall be resolved through [method, e.g., amicable negotiation, mediation, arbitration in Malaysia].

10. Entire Agreement:

This Agreement, including the Schedules attached hereto, constitutes the entire agreement between the parties and supersedes all prior or contemporaneous communications and proposals, whether oral or written, relating to the subject matter hereof.

11. Amendments:

No amendment to this Agreement shall be effective unless it is in writing and signed by duly authorized representatives of both parties.

12. Notices:

All notices and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered personally, sent by registered mail, or sent by reputable overnight courier service to the addresses set forth above.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

For [Your Company Name] For [EOR Company Name]

By: _________________________ By: _________________________

Name: Name:

Title: Title:

Schedules:

Schedule A: List of Employees

Schedule B: Employee Benefits

Schedule C: Fees and Payment Terms

Schedule A: List of Employees

Effective Date of Schedule: [Date this schedule becomes effective, which could be the Agreement's effective date or a later date for subsequent employees]

Employee ID (Optional) | Full Name | Job Title | Start Date (with EOR) | Reporting Manager (at Client) | Work Location (City, State) | Salary (MYR per month) | Benefits Enrollment (Y/N) | Notes (Optional) |

EMP-001 | Alice Tan | Marketing Manager | 2025-05-15 | John Lee | Kuala Lumpur, Selangor | 12,000 | Y | |

EMP-002 | Ben Lim | Software Engineer | 2025-06-01 | Sarah Wong | Penang, Penang | 10,000 | Y | |

EMP-003 | Siti Abdullah | Customer Support Specialist | 2025-06-15 | David Chen | Johor Bahru, Johor | 6,500 | Y | |

EMP-004 | Raj Kumar | Sales Representative | 2025-07-01 | Alice Tan | Petaling Jaya, Selangor | 8,000 | Y | |

Updates: | ||||||||

Date: | Employee Added/Removed: | Details of Change: | ||||||

2025-07-15 | Added | Emily Chu, Project Coordinator, 2025-08-01, John Lee, Kuala Lumpur, 9,500, Y | ||||||

2025-08-31 | Removed | Ben Lim | Resignation | |||||

Schedule B: Employee Benefits

Effective Date of Schedule: [Date this schedule becomes effective, which could be the Agreement's effective date or a later date]

This Schedule outlines the employee benefits provided to the Employees under this Agreement, in compliance with Malaysian Law and any additional benefits agreed upon by the Client and the EOR.

1. Statutory Benefits (Provided in Accordance with Malaysian Law):

Employees Provident Fund (EPF): Contributions will be made in accordance with the prevailing statutory rates, currently [Specify current employee and employer contribution rates, e.g., Employee: 11%, Employer: 13% (subject to salary thresholds)].

Social Security Organization (SOCSO): Contributions will be made in accordance with the Employees' Social Security Act 1969 and the Employment Insurance System Act 2017, based on the Employees' salary and the applicable contribution tables.

Employment Insurance System (EIS): Contributions will be made in accordance with the Employment Insurance System Act 2017, based on the Employees' salary and the applicable contribution rates.

Annual Leave: Employees are entitled to annual leave in accordance with the Employment Act 1955, based on their length of service:

Less than 2 years of service: [Specify number] days per year.

2 years or more but less than 5 years of service: [Specify number] days per year.

5 years or more of service: [Specify number] days per year.

Sick Leave: Employees are entitled to paid sick leave in accordance with the Employment Act 1955:

Less than 2 years of service: [Specify number] days per year.

2 years or more but less than 5 years of service: [Specify number] days per year.

5 years or more of service: [Specify number] days per year. Hospitalization leave may also be applicable as per the Act.

Public Holidays: Employees are entitled to all gazetted public holidays in Malaysia.

Maternity Leave: Female employees are entitled to maternity leave in accordance with the Employment Act 1955, currently [Specify duration, e.g., 98 consecutive days].

Paternity Leave: Male employees are entitled to paternity leave as per current regulations, currently [Specify duration, e.g., 7 consecutive days, subject to eligibility].

Other Statutory Benefits: Any other benefits mandated by Malaysian Law will be provided as required.

2. Additional Benefits:

Health Insurance: [Specify details of any additional health insurance coverage provided, e.g., Coverage level, provider, employee/employer contribution split].

Dental Insurance: [Specify details of any additional dental insurance coverage provided].

Vision Insurance: [Specify details of any additional vision insurance coverage provided].

Life Insurance: [Specify details of any life insurance coverage provided, e.g., Coverage amount].

Disability Insurance: [Specify details of any short-term or long-term disability insurance coverage].

Retirement Benefits (Beyond EPF): [Specify details of any additional retirement savings plans or contributions].

Transportation Allowance: [Specify amount or terms of any transportation allowance].

Meal Allowance: [Specify amount or terms of any meal allowance].

Mobile Phone Allowance: [Specify amount or terms of any mobile phone allowance].

Professional Development/Training Budget: [Specify any budget or provisions for employee training and development].

Other: [Specify any other agreed-upon benefits].

3. Administration of Benefits:

The EOR will be responsible for the administration of all statutory benefits in compliance with Malaysian Law.

For any additional benefits outlined in Section 2, the EOR will manage enrollment, contributions (if applicable), and payments in accordance with the terms agreed upon with the Client and the benefit providers.

Details regarding employee contributions (if any) for additional benefits will be communicated separately.

4. Changes to Benefits:

Any changes to the statutory benefits will be implemented as mandated by Malaysian Law.

Changes to the additional benefits outlined in Section 2 will require mutual written agreement between the Client and the EOR.

Key Considerations for Schedule B:

Cost Allocation: The main agreement's financial terms should detail how the costs of these benefits will be handled (e.g., included in service fees, pass-through expenses).

Schedule C: Fees and Payment Terms

Effective Date of Schedule: [Date this schedule becomes effective, which could be the Agreement's effective date]

This Schedule outlines the fees payable by the Client to the EOR for the Services provided under this Agreement, as well as the invoicing frequency and payment terms.

1. Service Fees:

Monthly Service Fee per Employee: [Specify Currency, e.g., MYR] [Specify Amount] per Employee per month. This fee covers the EOR's administrative services, including payroll processing, HR administration, and compliance management as outlined in the Agreement.

Onboarding Fee (Per New Employee): [Specify Currency, e.g., MYR] [Specify Amount] per new Employee added to Schedule A. This is a one-time fee to cover the initial onboarding process.

Offboarding Fee (Per Terminated Employee): [Specify Currency, e.g., MYR] [Specify Amount] per Employee upon termination of their employment under this Agreement. This fee covers the offboarding process.

Work Permit/Visa Processing Fees (if applicable): Fees for assisting with or managing work permit and visa applications for foreign nationals will be charged as follows:

Employment Pass Application: [Specify Currency, e.g., MYR] [Specify Amount] per application.

Professional Visit Pass Application: [Specify Currency, e.g., MYR] [Specify Amount] per application.

Renewal/Amendment Fees: Fees will be charged at the EOR's then-current rates or as specifically quoted.

Additional Services: Fees for any services requested by the Client that are outside the standard Scope of Services outlined in the Agreement will be agreed upon in writing on a case-by-case basis, either on an hourly rate of [Specify Currency, e.g., MYR] [Specify Amount] per hour or a fixed fee basis.

2. Reimbursable Expenses:

The Client shall reimburse the EOR for the following reasonable and documented expenses incurred in the provision of the Services:

Statutory Contributions: The actual costs of all mandatory statutory contributions in Malaysia, including but not limited to EPF, SOCSO, and EIS, based on the Employees' salaries and prevailing rates.

Employee Benefits Costs: The actual costs of any employee benefits provided as outlined in Schedule B, including employer contributions to health insurance, dental insurance, etc.

Work Permit/Visa Costs: All direct costs associated with obtaining and maintaining work permits and visas for foreign national Employees, including government fees and third-party charges.

Travel and Accommodation: Reasonable travel and accommodation expenses incurred by the EOR's personnel when required to provide on-site services (subject to prior Client approval).

Other Direct Costs: Any other direct costs reasonably incurred by the EOR in providing the Services, subject to prior Client approval where applicable.

3. Invoicing:

The EOR shall issue invoices to the Client on a [Specify Frequency, e.g., monthly] basis.

Invoices will include:

The Monthly Service Fees for all Employees listed in Schedule A for the relevant period.

Any applicable Onboarding or Offboarding Fees incurred during the invoicing period.

Itemized Reimbursable Expenses with supporting documentation where applicable.

A breakdown of all charges, including Employee names and the services rendered.

Invoices will be sent to the Client's designated billing contact via [Specify Method, e.g., email] to [Specify Email Address].

4. Payment Terms:

All invoices shall be paid by the Client within [Specify Number, e.g., thirty (30)] days from the date of the invoice (the "Payment Due Date").

Payments shall be made in [Specify Currency, e.g., MYR] via [Specify Payment Method(s), e.g., electronic funds transfer] to the EOR's bank account as detailed below:

Bank Name: [Specify Bank Name]

Account Name: [Specify Account Name]

Account Number: [Specify Account Number]

SWIFT Code (for international transfers): [Specify SWIFT Code, if applicable]

Late payments shall be subject to an interest charge of [Specify Percentage, e.g., 1.5%] per month, or the maximum rate permitted by applicable law, whichever is lower, calculated from the Payment Due Date until the date of actual payment.

All fees and expenses are exclusive of any applicable taxes (e.g., Sales and Service Tax - SST), which shall be borne by the Client at the prevailing rate.

5. Changes to Fees:

The EOR reserves the right to review and adjust the Service Fees upon [Specify Notice Period, e.g., sixty (60)] days' prior written notice to the Client. Any changes to fees will be effective at the start of the next calendar quarter following the notice period, unless otherwise agreed in writing.

Notes:

This schedule will be reviewed and may be updated by mutual written agreement of the Client and the EOR.

Any discrepancies in invoices must be reported to the EOR in writing within [Specify Number, e.g., fourteen (14)] days of the invoice date. Failure to do so will constitute acceptance of the invoice.

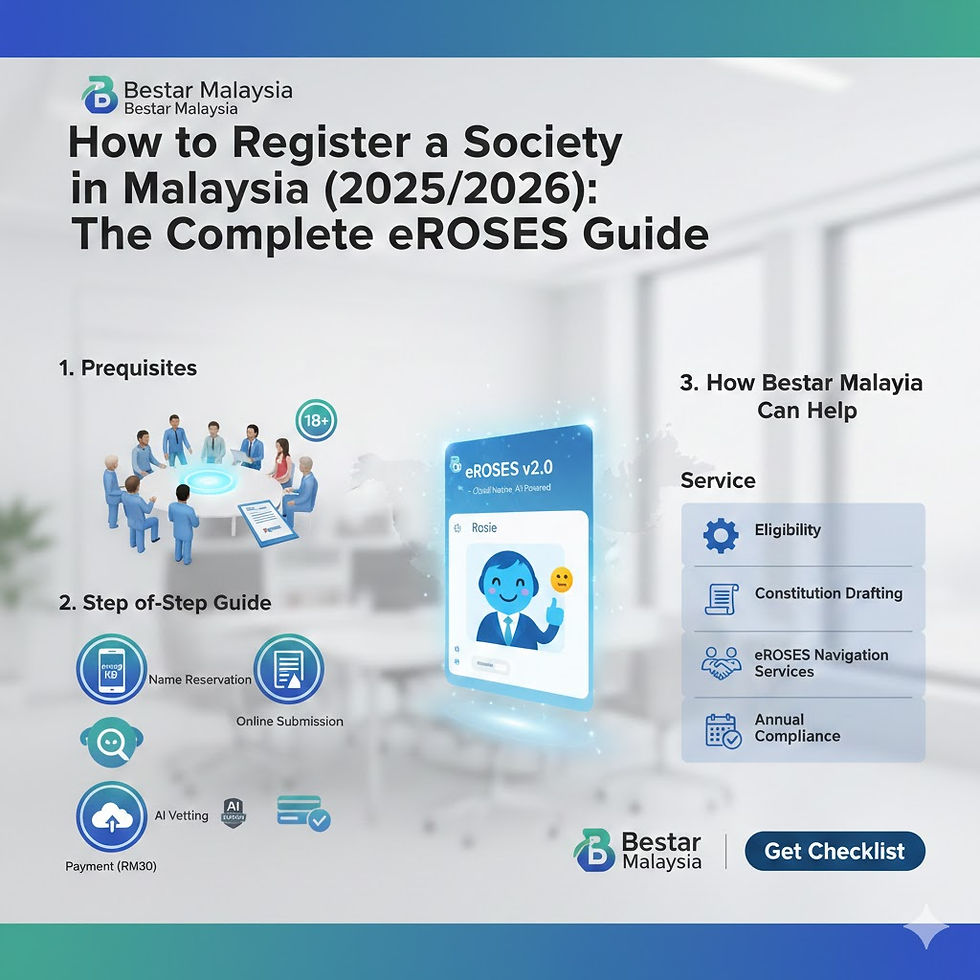

How Bestar can Help

Sample EOR Agreement in Malaysia

Here's a breakdown of how Bestar can help with an EOR arrangement:

Agreement Drafting and Review:

Ensuring Legal Compliance: Bestar will ensure the EOR agreement complies with all relevant legislation, including the Employment Act 1955, EPF Act, SOCSO Act, Income Tax Act, Personal Data Protection Act (PDPA) 2010, and any other applicable regulations.

Protecting Your Interests: We will review the agreement to identify potential risks and liabilities for your company and ensure the terms are fair and protect your interests regarding intellectual property, confidentiality, indemnification, and termination.

Customization: We can tailor the agreement to your specific needs and the nuances of your working relationship with the EOR and the employees.

Dispute Resolution Clauses: We will ensure the agreement includes clear and enforceable clauses for resolving any potential disputes.

Understanding Local Nuances: We possess in-depth knowledge of local legal practices and potential pitfalls in Malaysia.

Understanding Financial Implications:

Tax Compliance: We can advise on the tax implications of using an EOR in Malaysia, both for your company and the employees, ensuring compliance with Malaysian tax laws and regulations (e.g., withholding tax, corporate tax).

Cost Analysis: We can help you analyze the cost-effectiveness of using an EOR compared to setting up your own legal entity in Malaysia, considering all fees, expenses, and potential tax benefits or liabilities.

Payroll and Benefits Review: We can review the EOR's payroll and benefits administration processes to ensure accuracy and compliance with Malaysian financial regulations.

International Payments: We can advise on the most efficient and compliant methods for making payments to the EOR and for the EOR to pay employees in Malaysia.

Financial Reporting: We can help you understand how the EOR arrangement will impact your company's financial reporting and ensure proper accounting practices.

Expertise in Local Employment:

Navigating Malaysian Employment Law: Bestar specializes in understanding and adhering to the complexities of Malaysian employment laws, ensuring compliance with contracts, payroll, benefits, and termination procedures.

HR and Payroll Administration: We handle the day-to-day HR and payroll tasks, freeing up your internal resources.

Risk Mitigation: We take on the legal employer responsibilities, which can help mitigate some of the risks associated with employing individuals in a foreign country.

Work Permit and Visa Sponsorship (for foreign nationals): Bestar has experience in facilitating work permit and visa applications.

Local Market Knowledge: We have insights into local compensation and benefits norms.

In summary, Bestar works to ensure a smooth, legally compliant, and financially sound EOR arrangement in Malaysia:

Bestar focuses on the legal framework, protecting your company, and ensuring compliance with Malaysian law.

Bestar focuses on the financial implications, tax compliance, and cost-effectiveness.

Bestar offers the practical expertise and infrastructure for managing employment in Malaysia.

Engaging Bestar at the appropriate stages of the EOR setup process is crucial for a successful and compliant expansion into Malaysia.

Comments